|

|

|

What's News |

|

|

[ 2024-3-8 ]

Is it true to only take one day to set up an online corporate bank account?

|

For entrepreneurs to start a new business, it is necessary to open a bank account to receive payments. However, the difficulty of opening an account in Hong Kong is a pain point for entrepreneurs, and it definitely hinders Hong Kong's innovation and economic development.

For entrepreneurs to start a new business, it is necessary to open a bank account to receive payments. However, the difficulty of opening an account in Hong Kong is a pain point for entrepreneurs, and it definitely hinders Hong Kong's innovation and economic development.

Recently, some banks have made big promotions, claiming that they can successfully open an account in as little as 30 minutes to two days. Really? Can Hong Kong return to the high-efficiency environment of the 1980s and 1990s?

In order to seek the truth, our company tries to explore it personally. Our company selected a bank that claimed to open an account in one day and started online operations.

After submitting the form and relevant documents online, online identity verification will be performed immediately. However, there are many requirements for photographing ID cards, and facial recognition is not easy to identify. After spending a bit time, it finally passed online. The next step is to wait. Waited for a week, no reply. I called the "hot" hotline for enquiries, but received "cold" treatment as usual. Wait again, it’s been a month, still waiting…. It seems that these advertisements are only in the "advertising" stage.

Our company has many years of experience in working with banks and can effectively and expedite applications so that customers can start business as soon as possible. If you have any bank account and related needs, please feel free to contact us.

|

[ 2024-3-1 ]

Is it a timely help, or is it adding insult to injury?

|

The economy in 2024 will definitely be a year full of storms.

The economy in 2024 will definitely be a year full of storms.

The budget announced by the Financial Secretary on the 28th of this month included no other major relief measures except for the cancellation of the "new policy" in the property market, which may have a short-term impact on the economy.

The fiscal deficit in 2023/24 is 101.6 billion dollars, and the fiscal deficit in 24/25 is expected to be 48.1 billion dollars. No special measures were mentioned in terms of income source, but support for citizens and small and medium-sized enterprises has been reduced, and some measures may increase the burden.

Measures that have a direct impact on individuals and small and medium-sized enterprises are briefly described below:

1. Business registration fee: The business registration levy of 150 dollars is exempted, but the business registration fee will increase by 200 dollars, and the overall increase will be 50 dollars;

2. Salaries tax and personal assessment: For taxpayers whose annual net income exceeds 5 million dollars, the standard tax rate is 15% for the first 5 million, and 16% for the excess, which increases the burden on high-income earners;

3. For salaries tax, personal assessment and profits tax in 2023/24, the maximum reduction is reduced from 6,000 dollars in the previous year to 3,000 dollars, which will increase the burden of most taxpayers by 3,000;

4. The additional stamp duty, buyer’s stamp duty and new residential stamp duty on residential properties will be abolished with immediate effect. The new tax rates will be 100 dollars to 4.25%.

All taxpayers can make tax plans before the end of this tax year, so that they can be blessed and survive the cold winter. For more information on tax planning, please contact us.

|

[ 2024-2-23 ]

Online business are full of risks - some bigger risks

|

When doing business online, after applying for a business registration certificate, you still have to pay attention to the following risks you may have fallen:

When doing business online, after applying for a business registration certificate, you still have to pay attention to the following risks you may have fallen:

1. Do I need to pay tax? According to the tax regulations, businesses operating in Hong Kong, regardless of business size and form (online or physical), are required to report and pay Hong Kong profits tax. It is very clear. However, many friends who do business online do not file taxes or keep business records. The tax bureau can routinely trace transactions for seven or even ten years. Based on the assessment, taxes and fines may be required, and the fines can be up to three times the tax amount. When trading online through a platform, the transaction information is very detailed. The tax bureau only needs to ask the platform to provide it, and there is nothing to hide.

2. Company form: If you just apply a "unlimited company" to operate for the sake of convenience and saving money, your personal liability is unlimited. For example, if the goods sold result in injury or loss to others, the buyer can hold the seller responsible. The seller's liability is unlimited, so our company strongly recommends setting up a limited company to operate the business.

3. Insurance: If you have employees, whether full-time or part-time, you must purchase labor insurance. Otherwise, if any accident occurs to an employee, the company will still be held responsible.

Many friends who operate online businesses are deceiving themselves or taking chances and do not comply with the above legal requirements and do risk management. Once they are investigated by the government or have an accident, they will incur huge fines and compensation.

Doing business is long-term. To do big business, it is necessary to comply with all laws and manage risks. How can we do all of the above? Our company can assist. Welcome to contact our company.

|

[ 2024-2-16 ]

Online business is full of risks

|

In recent years, starting online business and become a Key Opinion Leader (KOL) have become popular, but people may have ignored some legal requirements and lacked awareness of risk management. If something goes wrong, they will fall into financial crisis or even be imprisoned. The first most common problem (mistake) is not applying for a business registration certificate.

In recent years, starting online business and become a Key Opinion Leader (KOL) have become popular, but people may have ignored some legal requirements and lacked awareness of risk management. If something goes wrong, they will fall into financial crisis or even be imprisoned. The first most common problem (mistake) is not applying for a business registration certificate.

Do you need to apply for a business registration certificate if you do small business online?

Yes. According to the Hong Kong Business Registration Ordinance, any form of activities conducted for profit in Hong Kong must apply for a business registration certificate. What is a profitable activity? Simply put as an activity that earn profits, including physical operations or online operations. In the past, the Hong Kong Inland Revenue Department has sent letters to some small online businesses, requiring them to pay fees and fines for not applying for business registration certificates in the previous years. Maybe it was during the epidemic at that time, people may not have aware of that.

In fact, there are some exemption clauses in the Business Registration Ordinance. Those with a small business scale can apply for exemption from paying business registration fees. Please note that the business registration fee can be waived, but you still need to apply for a business registration certificate.

To apply for an exemption, the following requirements must be met:

For business that providing business services, the average monthly turnover shall not exceed hkd10,000, and for other industries, the monthly average turnover shall not exceed hkd30,000. However, if the proprietor has other businesses, he is not eligible to apply for exemption.

There are other things need to be aware of when running a business online. We will share it with you in the future. Please "Like" and "Follow" our Facebook page so that you can receive useful information as soon as possible in the future.

|

[ 2024-2-9 ]

Things you must do during Chinese New Year.

|

What you must do in the New Year, of course, is to pay New Year's visit🤣

The past Year of the Rabbit fully demonstrated the rabbit's liveliness, and the past of epidemic has made people full of joy and expectations, However, people's livelihood and economy have not been reach the expectation and with disappointment. Yet, memories are always beautiful.

This year, the Year of the Dragon, according to economists and political experts, is a year of fluctuations and changes, and a year full of challenges. But no matter what the environment is, there is always an opportunity. If you can seize the opportunity and avoid the risks, you will have a different scenery. The new year is always full of hope.

Edward So & Co. and Easiview Business Services Group wish all customers, friends and partners, in the Year of the Dragon: See the dragon in the fields and the flying dragon in the sky.

Congratulations😍😍

|

[ 2024-2-2 ]

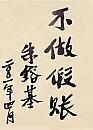

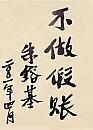

What is the "artistic conception" of your business in 2024?

|

What is the "artistic conception" of your business in 2024?

What is the "artistic conception" of your business in 2024?

Let’s go back and talk about what “artistic conception” is. The word artistic conception is relatively artistic, but it can be simply explained as: the blending of reality and imaginary scenes, the image of virtuality and reality, and the imaginative space it induces and develops, which refers to an ideal and happy state.

If you have a certain "artistic conception" about your business, you will have the opportunity to practice that "artistic conception". If there is no "artistic conception", there is naturally no so-called achievement. Therefore, everyone can take advantage of the fact that it is the beginning of the year and there is a long holiday next week to plan the "mood" of the business in 2024.

At the beginning of January, our company held a "Work Strategy for the New Year" workshop for employees. Through activities, the importance of making work preparations at the beginning of the year is highlighted, consolidating and improving work quality and efficiency, and making full preparations to help customers achieve their business "mood" in the new year.

As long as you formulate the "artistic conception" of your business, and with the assistance of "Artistic Business Group", you will be able to realize the "artistic conception" of your business for 24 years. Welcome to contact us to see how we can help realize your "artistic conception".

|

[ 2024-1-25 ]

How much do you know about Limited Company?

|

"Limited Company" can be seen and heard everywhere in today's society. When it comes to your knowledge about "Limited Company" Are you also a "limited company"?

"Limited Company" can be seen and heard everywhere in today's society. When it comes to your knowledge about "Limited Company" Are you also a "limited company"?

According to information released by the Hong Kong Companies Registry, at the end of 2023, there were 1.43 million limited companies in Hong Kong, with an average of one limited company for every 5 people; there will be 130,000 newly established limited companies in 2023, with an average of 500 people every working day. With the establishment of new companies, it can be seen that the application of limited companies is very extensive in Hong Kong.

What exactly is a "limited company"? Why is it called "Limited Company"? Basically, "limited" means that the shareholder's liability to the company or creditors is only limited (limited) to the company capital subscribed by him. The shareholder is not responsible for additional company debts.

Why use a limited company? What is the difference from unlimited company?

The main differences are as follows:

1. Control risks: As mentioned above, when a shareholder operates legally, his liability to the company and creditors is limited to his subscribed capital to the company, and he does not need to bear liabilities exceeding this amount. In this way, he can control the business risks.

2. Reputation: Most people think of a limited company as a relatively formal and large-scale company. Compared with unlimited companies, the perception is that of small-scale or individual operations;

3. Tax incentives: The Hong Kong tax regulations are relatively loose on the deductible expenses of a limited company, and more deductible expenses are available, especially expenses related to shareholders/directors.

In addition to companies registered in Hong Kong, companies in other countries/regions can also be used in daily business to match different business strategies.

Our company is a licensed "Trust and Company Service Provider" company in Hong Kong, which can assist in the establishment of various companies and provide comprehensive corporate services. If you have any questions about company establishment or company operation/maintenance, please feel free to contact us.

|

[ 2024-1-19 ]

Unveiling the mystery of Edward So & Co/Easiview Group

|

Unveiling the mystery of Edward So & Co/Easiview Group

Unveiling the mystery of Edward So & Co/Easiview Group

Anyone who has the opportunity to read this article are all friends, customers and supporters of our company, and they may have known each other for some time. But how well do you know our company? In addition to being a CPA firm in Hong Kong and providing accounting work, what else does our company do? Why are there so many employees and they are so busy? Why do we have offices in both China and Hong Kong? Why does Edward So CPA actively participate in various chambers of commerce and community services, seemingly spending a lot of time? Why......

Mr. Edward So recently accepted an interview with the media "Soft News" and explained our company's business philosophy, business purpose, scope of work, our company's advantages, and the differences with other colleagues in the industry. He also explained our company's internal philosophy and working methods. The contents that are less disclosed to the outside world are revealed one by one.

Dear friends and customers, please spend a little time to click on the following page to read and learn more about our company. We hope that everyone can cooperate more closely in business in the future to achieve our company's vision: "To grow together with our customers and to enjoy the results."

Related access links:

https://softnews.hk/%E8%98%87%E5%9C%8B%E6%A6%AE%E6%9C%83%E8%A8%88%E5%B8%AB%E4%BA%8B%E5%8B%99%E6%89%80/

|

[ 2024-1-12 ]

Twin brothers file lawsuit?

|

Twin births are a natural phenomenon. Twin brothers are related by blood and love each other even more. Can trademarks also have twin? This is definitely unusual and will trigger a lawsuit.

Twin births are a natural phenomenon. Twin brothers are related by blood and love each other even more. Can trademarks also have twin? This is definitely unusual and will trigger a lawsuit.

According to reports, Luckin Coffee, China’s largest chain coffee brand, recently sued Thailand’s Royal 50R Group for trademark and copyright infringement. The logos of the two companies are almost the same, both are a deer, but one deer is facing to the left and the other is facing to the right (see picture).

Luckin Coffee has been operating and using this trademark for more than 7 years. When registering the trademark in Thailand in 2021, it was rejected because a similar trademark was already registered in Thailand in 2019. Later, Luckin Coffee sued 50R Group for infringement. However, because 50R Group registered the trademark earlier than Luckin Coffee, Luckin Coffee ultimately lost the lawsuit. Recently, Luckin Coffee was sued, demanding compensation of 10 billion baht for economic losses.

According to Thailand's trademark law (also a common international practice), whoever registers first owns the trademark rights. Therefore, trademarks need to be registered as early as possible, otherwise the rights will be lost if others register them first. When registering, one must pay attention to the classification of the registered trademark. If the registration is wrong or the relevant classification is missing, the trademark will not be properly protected. Therefore, it is necessary to find an experienced service provider to register a trademark, otherwise it will be in vain.

Our company has many years of experience in handling trademark registrations for clients, including registration in Hong Kong, China and around the world. If you have any questions about trademark registration or need to register a trademark, please feel free to contact us.

|

[ 2024-1-5 ]

Paying tax on time

|

One year has passed since the epidemic, and the work of the tax bureau has gradually returned to normal.

One year has passed since the epidemic, and the work of the tax bureau has gradually returned to normal.

The number of tax surcharge notices and tax recovery notices issued by the tax bureau this year has increased significantly compared with the previous year. Among them, there were as many as 250,000 tax recovery notices that were levied with a 5% surcharge due to late payment of taxes, an increase of 22% from the previous year.

Taxpayers have to deal with this "active" work only by paying taxes on time. Those who fail to pay taxes on time will generally be levied a 5% surcharge; if the tax arrears exceed 6 months, a further 10% surcharge will be levied on the total amount owed. The Inland Revenue Department can even require employers, banks, etc. to directly withhold taxes without prior notice, or initiate legal proceedings to prohibit tax defaulters from leaving Hong Kong, or even apply for bankruptcy/liquidation, etc. Therefore, the consequences of owing taxes can be severe.

Most salaries tax, profits tax, etc. are due in January. To avoid the above consequences, please remember to pay taxes on time. If the expected income in 2023/24 decreases by more than 10% compared to the previous year, you can apply for a deferment of the corresponding prepayment tax, but the application must be submitted one month before the tax payment date.

If you want to apply for reduction or exemption of prepaid tax, or if you want to legally reduce your tax burden through tax planning, please contact us.

|

[ 2023-12-29 ]

"It's Christmas again, it's Christmas again..."

|

The sound of Christmas carols means that Christmas is here again, and it also means that the year is coming to an end.

The sound of Christmas carols means that Christmas is here again, and it also means that the year is coming to an end.

2023 was once a year full of expectations, but it became the most disappointing year. After the epidemic, the expected economic recovery did not appear. On the contrary, the economic situation may be worse than during the epidemic. The economic atmosphere is like a roller coaster ride.

But no matter what, Christmas is a day celebrated by everyone. Our company also held an employee Christmas party on Christmas Eve. Of course, a party is indispensable with food and games. After a full meal, everyone participating in games and take a break from busy work. Indispensable, of course, are the prizes. The company and department heads generously gave away prizes in the lottery. The employees who won the prizes were of course very happy. The most important element of the party - laughter, filled the entire Christmas party.

Christmas also means that the new year is about to begin. Everyone must make a good work plan for the new year and prepare to face challenging year of 2024. Please remember that Edward So & Co. is your strongest business support and your best business partner. Let us grow together and share the results.

|

[ 2023-12-22 ]

What to do during the Christmas holidays?

|

The Hong Kong Central District Commerce and Industry Association (CDA) held a Christmas party on the evening of December 20. More than 100 members and friends attended the event that night, and the atmosphere was warm and lively.

The Hong Kong Central District Commerce and Industry Association (CDA) held a Christmas party on the evening of December 20. More than 100 members and friends attended the event that night, and the atmosphere was warm and lively.

Accountant Edward So is the president of CDA and delivered a speech before the party: The meaning of the Christmas holiday lies in two aspects: First, everyone has worked hard for a year, and it is time to take advantage of the Christmas holiday to have a good rest and relax . Second, right after the holidays is the beginning of a new year. During the Christmas holidays, we should set new directions and work plans for the new year and meet future opportunities and challenges.

Although the economy in 2023 will be worse than expected, and 2024 may not be promising, there are always different opportunities in a slow market. If you can seize the opportunities, you can still develop; you can also do the basic work well to welcome the economic recovery in 2025.

That night, Mr.Lawrence Lau, the "Treasure of ATV", was specially invited to play Santa Claus and deliver gifts, which caused a commotion. Since there are more friends who donate prizes, many participants can truly "win the prize twice" and come home with a full load.

We hope that all our friends and customers can make good use of this Christmas holiday and prepare for next year. Our company will be your most reliable business partner.

|

[ 2023-12-14 ]

Unique Business Identifier

|

According to statistics, there are 1.93 million limited companies in Hong Kong.

According to statistics, there are 1.93 million limited companies in Hong Kong.

There are 1.93 million companies received a letter from the Hong Kong Companies Registry last month regarding the "Unique Business Identifier". What exactly is a "unique business identifier"? Why go to all this trouble to send out 1.93 million letters?

In the past, every limited company was issued a business registration certificate by the Inland Revenue Department and had a business registration certificate number; on the other hand, a Certificate of Incorporation was issued by the Companies Registry and had a company number. Two different numbers both represent the company's registration identification.

Starting from December 27, 2023, the company number will be cancelled, and only the business registration certificate number will be used as the unique identification number of the company's identity, which is the "unique business identifier" , which is the previous business registration certificate number will be used.

Therefore, when you receive this letter, you only need to know the above things and do not need to take any action.

The purpose of the company secretarial services provided by our company is to help customers handle company laws and compliance issues simply and easily, so that customers do not need to spend too much time and energy dealing with these non-business matters. Our goal is to simplify the complex and enable our customers to improve their overall productivity.

If customers need company secretarial services, such as: company establishment (Hong Kong, China and overseas companies), annual compliance review, equity changes, structure establishment, etc., please feel free to contact our company.

|

[ 2023-12-6 ]

Is it really as simple as signing a name?

|

I often hear people say that to issue an audit report is as simple as “signing your name” However, do you have any idea why it cost so expensive and require hours to complete an audit report ?

I often hear people say that to issue an audit report is as simple as “signing your name” However, do you have any idea why it cost so expensive and require hours to complete an audit report ?

Is it really as simple as "signing your name"? If it's so simple, why do Accountants need to study a lot? Why do they need to take so many tests? Why they call a professional?

The Accounting and Financial Reporting Council (the regulatory body for the accounting industry) announced last week that an accountant licence was permanently suspended and had to pay a fine of hkd 300,000 for "blindly signing" an audit report, which is, issued an audit report without doing proper audit work. Client who have been subject to the issuance of audit reports may also be investigated by relevant agencies.

Permanent suspension may seem serious, but in fact, accountants may be held criminally liable if they commit misconduct. It can be seen from this that it is definitely not as simple as “signing your name”.

Why can the tax bureau rely on the audit report signed by the accountant for tax assessment, the bank can rely on it as the basis for loan, and the investor can use it as the basis for making investment decision? It is because accountants have professional knowledge, can judge the accuracy of figures, and have professional ethics that they generally do not mess around, so they are recognized by all industries. It's just that there are dead branches in the tree. Some low-quality accountants offer low prices and issue reports at high speed, which is "blind signing". This makes business people mistakenly think that accountants who work normally and charge normal fees are expensive and work slowly. , causing serious misunderstandings.

Our audit work must be carried out according to normal procedures. The purpose is also to protect our client. The audit accounts obtained will be trusted by other users. If you have any questions about the audit, please feel free to contact our company.

|

[ 2023-12-1 ]

The transformation of CCKT

|

The "CCKT" brand has entered a new stage after several years of development.

The "CCKT" brand has entered a new stage after several years of development.

On November 28, CCKT held the opening ceremony of its new office in Shenzhen, and invited nearly a hundred business partners, business friends and good friends to attend. It was crowded, everyone was enthusiastic and very lively.

After the opening ceremony, Accountant Edward So announced the three major directions of CCKT:

1. CCKT has moved into a new office. The area has been enlarged and the number of staff has increased, but the actual significance is to cast a vote of confidence in China, Hong Kong and our business;

2. CCKT has been operating family trust business for some time. Now in line with the general trend of family offices, CCKT will strengthen the trust business and officially change its name to "CCKT Family Office";

3. the International Asset and Risk Management Association has established the iARMA Charitable Fund to provide training and promotion of financial management, entrepreneurship, risk management and family trusts, especially training for young people to enhance their understanding of financial management, risk management and family trusts.

The CCKT Family Office will continue to develop the family trust business with its partners and business friends. If you would like to learn more about family trusts and related business opportunities, please feel free to contact us.

|

|

-

|

|

|

|

Homepage

Homepage

Company Profile

Company Profile

Services

Services

Legal and Regulatory Notice

Legal and Regulatory Notice

Download

Download

Useful Websites

Useful Websites

HK Business Environment

HK Business Environment

Tax System in HK

Tax System in HK

Companies in Different Jurisdiction

Companies in Different Jurisdiction

Business Partner

Business Partner

Event

Event

Contact Us

Contact Us